Burn Rate Business . Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. It's the rate of negative cash flow, usually quoted as a. Startups with venture capital funding. Burn rate (or cash burn rate) is a critical metric to three types of businesses: Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. Burn rate explains how quickly your business is using up its cash reserves. It’s a metric that helps your startup (and investors) understand exactly. It’s often calculated by month. Burn rate refers to the rate at which a company spends its supply of cash over time.

from www.feedough.com

It’s a metric that helps your startup (and investors) understand exactly. Burn rate explains how quickly your business is using up its cash reserves. Startups with venture capital funding. Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. It’s often calculated by month. Burn rate refers to the rate at which a company spends its supply of cash over time. It's the rate of negative cash flow, usually quoted as a. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate (or cash burn rate) is a critical metric to three types of businesses:

What Is Burn Rate & Startup Runway? Feedough

Burn Rate Business Burn rate (or cash burn rate) is a critical metric to three types of businesses: Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. Burn rate explains how quickly your business is using up its cash reserves. It's the rate of negative cash flow, usually quoted as a. Burn rate refers to the rate at which a company spends its supply of cash over time. It’s a metric that helps your startup (and investors) understand exactly. Startups with venture capital funding. Burn rate (or cash burn rate) is a critical metric to three types of businesses: It’s often calculated by month. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses.

From www.toptal.com

How to Calculate and Optimize Startup Burn Rate Toptal® Burn Rate Business Burn rate (or cash burn rate) is a critical metric to three types of businesses: Burn rate explains how quickly your business is using up its cash reserves. Startups with venture capital funding. Burn rate refers to the rate at which a company spends its supply of cash over time. It’s a metric that helps your startup (and investors) understand. Burn Rate Business.

From www.investopedia.com

How the Burn Rate Is a Key Factor in a Company's Sustainability Burn Rate Business It's the rate of negative cash flow, usually quoted as a. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. Burn rate refers to the rate at which a company spends its supply of cash over time. It’s often calculated by month. Startups with venture capital funding. Burn rate, or. Burn Rate Business.

From www.planprojections.com

Cash Archives Plan Projections Burn Rate Business It’s often calculated by month. It's the rate of negative cash flow, usually quoted as a. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate refers to the rate at which a company spends its supply of cash over time. Startups with venture capital funding. Burn rate. Burn Rate Business.

From finmark.com

What is Burn Rate? (How to Calculate Burn Rate) Finmark Burn Rate Business Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. Burn rate (or cash burn rate) is a critical metric to three types of businesses: It’s a metric that helps your startup (and investors) understand exactly. Burn rate is important for small businesses because it helps them to avoid financial difficulties. Burn Rate Business.

From excel-dashboards.com

Get Cash Burn Rate Excel Template ExcelDashboards Burn Rate Business Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. It's the rate of negative cash flow, usually quoted as a. It’s a metric that helps your startup (and investors) understand exactly. Burn rate is the amount of money your business needs in a certain period—usually a. Burn Rate Business.

From baremetrics.com

What is Your Business’s Burn Rate? Burn Rate Business Burn rate (or cash burn rate) is a critical metric to three types of businesses: Burn rate explains how quickly your business is using up its cash reserves. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. It's the rate of negative cash flow, usually quoted as a. Burn rate. Burn Rate Business.

From www.slideserve.com

PPT BURN RATES PowerPoint Presentation, free download ID2736564 Burn Rate Business Startups with venture capital funding. It’s a metric that helps your startup (and investors) understand exactly. It's the rate of negative cash flow, usually quoted as a. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate is the amount of money your business needs in a certain. Burn Rate Business.

From www.profit.co

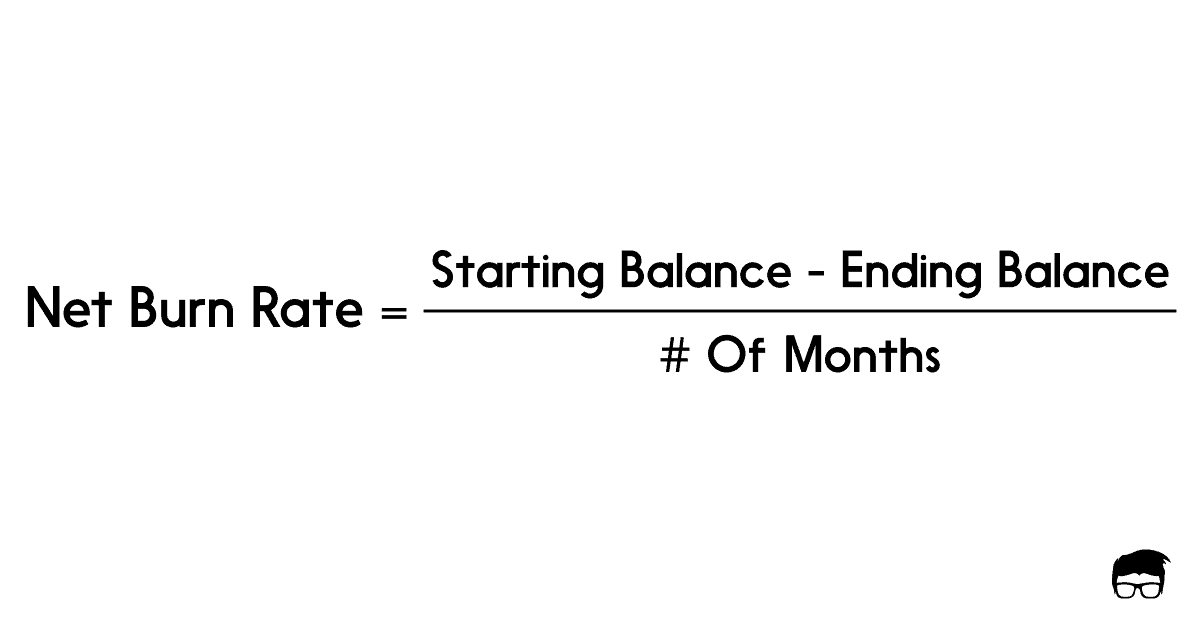

What Is Net Burn Rate? Impact and Control of Burn Rate Burn Rate Business It’s a metric that helps your startup (and investors) understand exactly. Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. It’s often calculated by month. Burn rate explains how quickly your business is using up its cash reserves. It's the rate of negative cash flow, usually. Burn Rate Business.

From www.smartsheet.com

PPE Burn Rate Calculator Smartsheet Burn Rate Business Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate explains how quickly your business is using up its cash reserves. Burn rate refers to. Burn Rate Business.

From finmodelslab.com

Get Cash Burn Rate Excel Template Burn Rate Business Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate (or cash burn rate) is a critical metric to three types of businesses: It’s often calculated by month. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. Burn. Burn Rate Business.

From finmark.com

What is Burn Rate? (How to Calculate Burn Rate) Finmark Burn Rate Business Startups with venture capital funding. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. It's the rate of negative cash flow, usually quoted as a. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. Burn rate (or cash burn. Burn Rate Business.

From www.setindiabiz.com

Business Burn Rate Burn rate business tips keep control Burn Rate Business It’s often calculated by month. Burn rate refers to the rate at which a company spends its supply of cash over time. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. It's the rate of negative cash flow, usually quoted as a. Burn rate, or negative cash flow, is. Burn Rate Business.

From www.techslang.com

What is Burn Rate? — Definition by Techslang Burn Rate Business Burn rate (or cash burn rate) is a critical metric to three types of businesses: It’s a metric that helps your startup (and investors) understand exactly. Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. It’s often calculated by month. Startups with venture capital funding. Burn. Burn Rate Business.

From businesshubone.com

How to Calculate Burn Rate Business Hub One Burn Rate Business It’s often calculated by month. It’s a metric that helps your startup (and investors) understand exactly. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Startups with venture capital funding. Burn rate explains how quickly your business is using up its cash reserves. Burn rate refers to the rate. Burn Rate Business.

From www.investopedia.com

Burn Rate What It Is, 2 Types, Formula, and Examples Burn Rate Business Burn rate explains how quickly your business is using up its cash reserves. It’s often calculated by month. It’s a metric that helps your startup (and investors) understand exactly. Burn rate, or negative cash flow, is the pace at which a company spends money — usually venture capital — before reaching profitability. Startups with venture capital funding. Burn rate is. Burn Rate Business.

From www.youtube.com

All you need to know about Burn Rate Business Terms StartupLanes Burn Rate Business Startups with venture capital funding. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. It's the rate of negative cash flow, usually quoted as a. It’s a metric that helps your startup (and investors) understand exactly. Burn rate (or cash burn rate) is a critical metric to three types. Burn Rate Business.

From www.youtube.com

Cash Burn Rate Analysis Calculate Cash Burn YouTube Burn Rate Business Burn rate explains how quickly your business is using up its cash reserves. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. It’s often calculated by month. Burn rate refers to the rate at which a company spends its supply of cash over time. Burn rate is important for small. Burn Rate Business.

From blog.getlatka.com

What is Burn Rate? Definition, Formula, Example, and More Burn Rate Business It’s often calculated by month. It’s a metric that helps your startup (and investors) understand exactly. Burn rate is important for small businesses because it helps them to avoid financial difficulties and keep their business running. Burn rate explains how quickly your business is using up its cash reserves. Startups with venture capital funding. Burn rate (or cash burn rate). Burn Rate Business.